4 Simple Techniques For $255 Payday Loans Online Same Day

The Only Guide for $255 Payday Loans Online Same Day

Table of ContentsSome Known Factual Statements About $255 Payday Loans Online Same Day $255 Payday Loans Online Same Day Can Be Fun For AnyoneSome Known Incorrect Statements About $255 Payday Loans Online Same Day $255 Payday Loans Online Same Day for DummiesAll About $255 Payday Loans Online Same Day

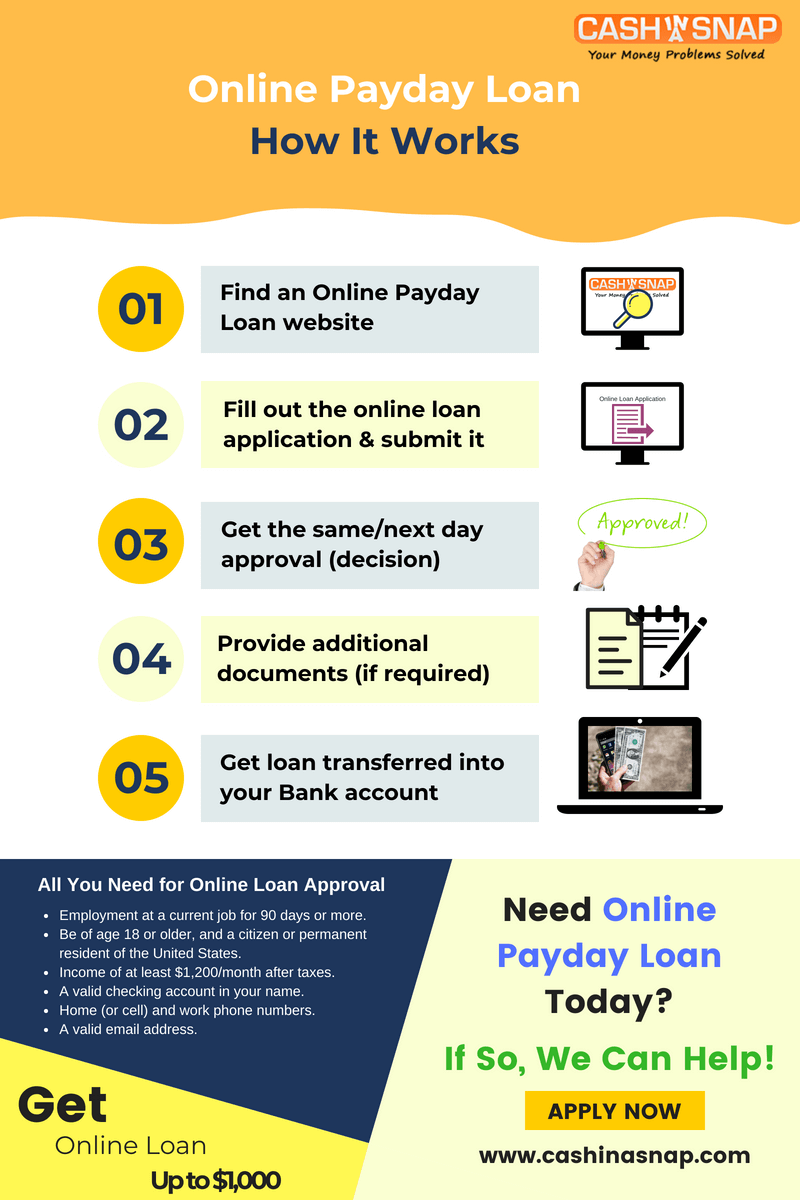

Payday advance are temporary cash loans based on the debtor's personal check held for future down payment or on electronic access to the debtor's checking account. Borrowers compose a personal look for the quantity borrowed plus the financing cost and get money. Sometimes, customers sign over electronic access to their bank accounts to receive and also repay cash advance.To pay a car loan, consumers can retrieve the check by paying the financing with cash, allow the check to be deposited at the bank, or just pay the money charge to roll the car loan over for one more pay duration. Some cash advance loan providers likewise use longer-term cash advance instalment car loans as well as request authorization to digitally withdraw several settlements from the borrower's savings account, usually due on each pay date.

:max_bytes(150000):strip_icc()/dotdash-title-loans-vs-payday-loans-which-are-better-Final-a61111fe80ff4f4f9a9b0eb9428ba803.jpg)

The ordinary financing term is concerning two weeks. Car loans typically cost 400% yearly interest (APR) or more.

All a customer needs to get a payday advance loan is an open bank account in fairly excellent standing, a constant income source, and also identification. Lenders do not conduct a complete credit scores check or ask inquiries to figure out if a borrower can afford to pay off the lending. Since lendings are made based on the loan provider's capability to accumulate, not the customer's capacity to pay back while meeting other financial responsibilities, payday advance loan produce a debt trap.

5 Easy Facts About $255 Payday Loans Online Same Day Described

Customers default on one in five cash advance. Online customers get on even worse. CFPB located that even more than fifty percent of all on the internet payday instalment funding series default. Cash advance financings are made by cash advance lending stores, or at shops that market various other monetary solutions, such as check paying, title financings, rent-to-own and also pawn, relying on state licensing demands.

CFPB found 15,766 payday advance loan stores running in 2015. High expense cash advance loaning is licensed by state laws or regulations in thirty-two states. Fifteen states and also the District of Columbia protect their consumers from high-cost payday loaning with sensible tiny financing rate caps or various other restrictions. Three states established lower price caps or longer terms for somewhat cheaper lendings.

For more information, see Lawful Standing of Payday Loans by State. Payday lendings are not permitted for active-duty solution members as well as their dependents. Federal defenses under the Military Financing Act (MLA) for solution members and also their households worked October 1, 2007 as well as were increased October 3, 2016. Department of Defense guidelines put on fundings based on the government Fact in Lending Act, consisting of cash advance and title fundings.

The Consumer Financial Defense Bureau imposes the MLA regulations. To submit a complaint, click here. See: CFA press release on changed MLA regulations.

The Definitive Guide for $255 Payday Loans Online Same Day

We have actually all seen them. informative post Brilliant yellow and red indicators with pledges of immediate money to aid you reach cash advance. And all you need to do is transfer your self-respect and any kind of remaining hopes of being financially secure in the near future. Yupwe're chatting about cash advance loan providers. They're look at these guys the bottom-feeders of the financial market.

What you really get is a little payday finance and also a heap of warm, steaming, lousy financial obligation. Cash advance car loans are fundings that assist you get from one payday to the following (for those times your paycheck can not extend to the end of the month).

And also to top everything off, Robert's credit rating is shot, as well as all of his bank card are maxed out. Really feeling determined, Robert drives to his local payday lending institution, skims the finance contract (right past the astronomical rates of interest), as well as indications his name on the populated line for $300.

In order for the lender to look previous his repayment history (or do not have thereof) and also bad credit report, Robert has to write a check dated for his following payday in the amount he borrowedplus passion. However what he doesn't recognize is that by authorizing up to get cash money fast, he just made a gent's contract with the debt evil one.

The 6-Second Trick For $255 Payday Loans Online Same Day

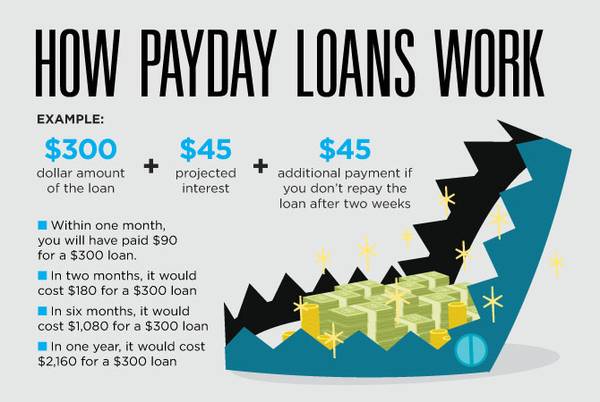

Robert took out a $300 car loan. At a 15% interest price for a two-week financing period, he racked up $45 in rate of interest. Yet he could not pay it back in 2 weeks, so he chose to extend the funding (for an additional fee obviously). Now his $300 finance has turned right into $360.

At the end of the cycle, Robert will certainly have only obtained $300 yet paid $105 in interest as well as costs to the lender. 50% annual rate of interest rate. Pay attention up: Payday lenders are the financial sector's mobsters.

You see, when you authorize up for a payday advance loan, you give the lender accessibility to your examining account so they can subtract what they're owed (plus a charge) on paydayor you have to write them a post-dated check.1 That's exactly internet how they know you're good for the cash. Payday lenders don't in fact care whether you can pay your expenses or not.

And to top all of it off, Robert's credit scores is shot, and all of his charge card are maxed out. Feeling determined, Robert drives to his regional payday loan provider, skims the financing agreement (appropriate past the astronomical rate of interest), and also indicators his name on the populated line in exchange for $300 ($255 Payday loans online same day).

Getting The $255 Payday Loans Online Same Day To Work

In order for the lending institution to look previous his settlement history (or do not have thereof) as well as poor credit rating, Robert has to create a check dated for his following payday in the quantity he borrowedplus interest. What he doesn't recognize is that by authorizing up to get cash quick, he simply made a gentleman's contract with the financial debt devil.

At a 15% passion rate for a two-week car loan period, he racked up $45 in rate of interest. He could not pay it back in two weeks, so he made a decision to expand the lending (for another charge of course).

At the end of the cycle, Robert will have only obtained $300 however paid $105 in interest and fees to the lender. 50% yearly interest rate. Pay attention up: Cash advance loan providers are the monetary industry's mobsters.

You see, when you enroll in a payday advance loan, you provide the lending institution accessibility to your inspecting account so they can deduct what they're owed (plus a charge) on paydayor you have to create them a post-dated check.1 That's exactly how they know you're good for the money. Cash advance loan providers do not really care whether you can pay your bills or otherwise.